Whether you’ve just started looking for your dream home or you’ve been researching for a while, the taxes involved in buying a property is an issue that worries everyone who decides to take the big step. In your search you’ve probably come across the terms “ITP or VAT” when looking on property portals or estate agents, but what is VAT and what is ITP? Are they a kind of “stamp duty”? And in which case does each one apply?

When you first start looking to buy a property in Spain the term “ITP” might pop out. But, What is ITP?

Second hand properties are not charged with VAT (IVA in Spanish), however these resales come across with a tax called ITP “Impuesto sobre Transmisiones Patrimoniales”, which is a transfer Tax set at autonomous community level.

As this tax is ceded to the autonomous regions it varies across the country, being around 6% in Communities such as Madrid or The Canaries Island and 10% in others as Catalonia or Valencia.

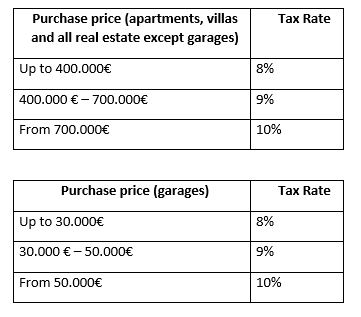

ITP applies to all real estate, with just a difference in ranges of prices in the garages. You will have to take this expense into consideration when looking at your budget, as this tax is not usually included in the price shown in the advertisings.

UPDATE 28/04/2021: Andalusia has reduced the ITP rates, from the previous 8%, 9% and 10% (see table below) to a unique general rate of 7% for all resale properties. Meaning that now, buyers would be paying less taxes for a second home. This is valid until 31st December 2021.

The following table shows the ITP rates for Andalucia (2020) :

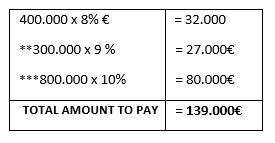

The ITP tax is accumulative, meaning that the first 400.000€ are charged at 8%, and the rest that overpass that amount will be charged at the pertinent percentage. As an example, a property of 1.500.000€ will be charged as followed:

** The second section is the amount between 700.000 €- 400.000 € = 300.000 € charged at 9%

*** 1.500.000€ – 700.000€ = 800.000€ Charged at 10% as per the third section of the tax regulation.

This tax must be paid by the buyer within the next 30 days after the purchase of the property.

This tax is not “stamp duty” as we know it in the UK. There is a form of stamp duty in Spain called AJD (Actos Juridicos Documentados) on all notarization of documents. AJD is only payable on land and new property sales. The rate can be up to 1.5%.

UPDATE 28/04/2021: Andalusia has reduced the AJD from 1.5% to 1.2%. This percentage applies until 31st December 2021.

| Autonomous community | General Tax Rate | Exceptions |

| Andalucía | 8%-10% | 3,50% For a primary residence of no more than 130,000 euros for a person under 35 years of age, or of no more than 180,000 euros for a person with a disability equal to or greater than 33%. |

| Aragón | 8-10% | 50% discount on the tax quota For the primary residences of large families |

| Asturias | 8-10% | 3% For subsidised housing. |

| Canarias | 6,50% | 4% For a regular home for a large family, or for a person under 35 years of age, or for a physically disabled person, or for a subsidised home. |

| Islas Baleares | 8-11% | |

| Cantabria | 8-10% | 5% For a home for a large family, or for a person under 30 years of age, or for a person with a mental or sensory handicap of between 33% and 65%, or for a social housing. It is 4% if the disability is greater than 65%. |

| Castilla y León | 8% | 4% For a primary residence for a numerous family, or purchaser or family member with a disability of at least 65%, or all purchasers are under 36 years of age and it is their first home, or for subsidised housing that is their first home. |

| Cataluña | 10-11% | 5% For large families, under 32 years of age, or people with disabilities. |

| Extremadura | 8-11% | 7% Value of less than 122,000 euros and the sum of the general and savings taxable income of the purchaser is less than 19,000 euros (individual) or 24,000 euros (joint) and the total income of the family is less than 30,000 euros, increased by 3,000 euros for each child. It is 4% for a state-subsidised home, with a 20% rebate if it is the habitual residence to which the rate of 7% is applied, if under 35 years of age, or a large family, or a disability of over 65%. |

| Galicia | 10% | 8% For a primary residence of a family with an income of less than 200,000 euros. It is 4% for a habitual residence of a person with a disability of at least 65%, or a large family with assets of less than 400,000 euros, or under 36 years of age. |

| Madrid | 6% | 4% For a primary residence for a large family. |

| Murcia | 8% | 4% For special regime subsidised housing. It is 3% for large families or under 35 years of age. |

| La Rioja | 7% | 5% For subsidised housing, or the constitution and transfer of rights over them, or the habitual residence of people under 36 years of age. |

| Comunidad Valenciana | 10% | 8% For general public subsidised housing or the first permanent residence of people under 35 years of age. It is 4% for special regime public housing, or for large families, or for people with a physical or sensory disability of over 65%, or a mental disability equal to or greater than 33%. |

| Navarra | 6% | 5% For the first 180,303.63 euros of a primary residence for families with more than three members. |

| País Vasco | 4% | 2.50% For large families. |

From Andalucia Realty, we understand that the process of buying a new property and the taxes related to it might be confusing for first time buyers. Therefore we advise and help our clients before, during and after the purchase, and our team of experts will take care of guiding you through all the process.