If you are tax based in Spain, the profit obtained by the sale of a property constitutes an income subject to the payment of the Capital Gain Tax (IRPF in Spanish). This increase in an individual’s wealth can be taxed up to 23%, or in certain cases even be exempt. But how does the tax office calculate the profit obtained when selling a property in Spain? How much is paid to the tax office for the sale of a flat? What do we have to take into account? What if you are a non resident, will you have to pay for selling a property in Spain? In this post we are going to give answers to all these questions for both, residents and Non residents in Spain:

I sold my house in Spain. How much do I have to pay for the Capital Gain Tax?

If you are a Non Residents in Spain:

If you are a Non Residents in Spain (but resident in EU country), you will have to pay 19% on the profit. However it is important to know that even if you are making no profit at all, and due to you being a Non Resident, the buyer of your property will be obliged to retain 3% of the sale price on account of your possible tax liability. Of course, if you have no tax liability at all because you are losing money with the sale, or your liability if less than the 3% retained, you will be entitled to a total or partial tax rebate, depending on the case.

If you are a resident in spain:

If you are a resident in spain The tax office takes as profit, the amount of money obtained by calculating the difference between the transfer value and the acquisition value.

The acquisition value must include all the expenses and taxes paid for the purchase of the property. Expenses such as notaries, administration offices, municipal taxes, etc., must be taken into account. Any type of interest paid on the purchase, such as mortgages or other loans, should not be included in this amount.

This information is found in the deed of sale of the property. It must detail the amount for which the home was acquired. In addition, you must have a copy of the notary and management costs that caused the purchase of it.

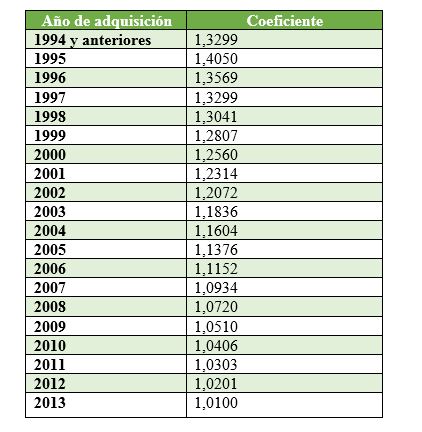

If the property had been bought before 2014, the acquisition value must be increased in accordance with the following table:

Coefficients Table

Source: Spanish Tax Agency.

The transfer value is calculated as the amount for which the property is sold, subtracting all the expenses and taxes that the buyer payed. In this case, the Plusvalía (municipal tax) is added as an expense borne by the buyer, as well as notary or management fees.

Practical example of how much is paid to the tax authorities for the sale of a house:

Maria bought a second hand home in Marbella in 2012 for a registered amount of €200,000. She had expenses of 380€ in agency, 740€ of notary, 450€ of Registry and 16.000€ of “Autoliquidación of Taxes” (Tax of patrimonial transmissions or Impuesto de transmisiones patrimoniales model 600).

For the calculation of the Purchase Value we add to the deeded amount all the expenses caused by the purchase of the property (without interest). In this case it would be:

200.000€ + 380 + 740+ 450 + 16000 = 217.570€

As the house was also purchased before 2014, according to the table above, the value should be increased as follows:

217.570€ * 1.0201 = 221.943,16€

The Acquisition Value of this property would be 221,943.16€.

In 2018 she sold the property for € 280,000, having to pay a municipal tax (Plusvalía) of 5,760€. (Simulation of a house in Marbella)

The transfer value is calculated as the amount received for the sale of the property less all costs arising therefrom that are borne by the buyer. In this example:

Transfer Value: 280.000€ – 5.760€ = 274.240€.

The profit from the sale is the difference between the transfer value and the acquisition value.

Profit: € 274,240 – € 221,943.16 = € 52,296.84

Once the profit has been obtained, the CGT can be calculated on that profit.

IRPF or Capital Gain tax in Spain calculation – How much will I pay?

In the case of the sale of a home, the tax brackets are 19% for the first €6,000 earned as a benefit of the sale, 21% from €6,000 to €50,000 and 23% from €50,000.

If we continue with the previous example:

(6.000 x 0.19) + (46.296, 84 x 0.21) = 1.140€ + 9.722,33€ = 10.862,33€.

So, following the example, Maria should pay to the Treasury € 10,862.33 in her annual income tax declaration.

In which cases the IRPF is not paid for the sale of a property.

There are cases in which the Transfer Value is higher than the Acquisition Value, so a loss is generated. In these situations where there are losses, the tax is not due.

Other circumstances in which the payment of the tax on the profit from the sale is exempt is if it is reinvested in the purchase or improvement of the main residence. (For residents in Spain)

Do you want to sell your house in Marbella? At Andalucia Realty we manage the sale of your home, also carrying out a market study to assess its competitiveness. As a sign of our confidence that we can sell your property, we offer you an investment valued at more than 2300€ in marketing for your property: professional photos, promotion in the first places on the web, virtual video…