It does not matter if you have just started looking for your ideal home or if you have been already searching for a while; most surely the terms “ITP or IVA” had pop out while looking to Property portals or real estate agencies , but what is IVA and what is ITP? And in which case applies each one?

Buying a property in Spain has different costs and expenses depending on which type of property you are buying, your personal conditions (age, legal status, nationality…) and even on which autonomous community you are thinking to buy.

As this might be very complicated at the begining for most of buyers, we are going to explain the two most important taxes that applies to all properties:

- IVA (or VAT in English) is a tax charged on most goods and services in Spain. The full rate and the most common one is 21%. However, on property sales it is reduced to 10%, only lands for property developments are charged at 21%, therefore be aware of which kind of property you want to buy and its taxation.

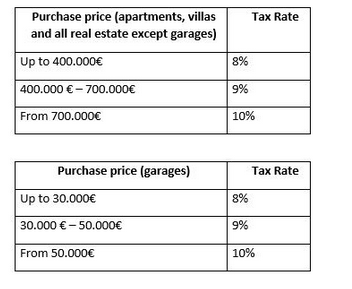

- ITP is a tax depending on the autonomous community. Is considered a transfer tax that in Andalucia is rated as following:

The main difference among these two taxes is that IVA (or VAT) is only charged to new property sales, while when buying a second-hand home you must pay ITP, which will be calculated depending on the community (Notice it is an accumulative tax).

Our aim is to make the process of buying a property in Spain as simple as possible for our clients, that’s why we will advise you through all steps of the purchase. The agency has the duty of informing the client with all these details, that must be resume in a document called DIA (compulsory in Andalucia).

You can know more about the documents needed to buy a property in Spain and about ITP in Andalucia, and other taxes and useful advices in our Real Estate Blog.